Best option trading tutorial

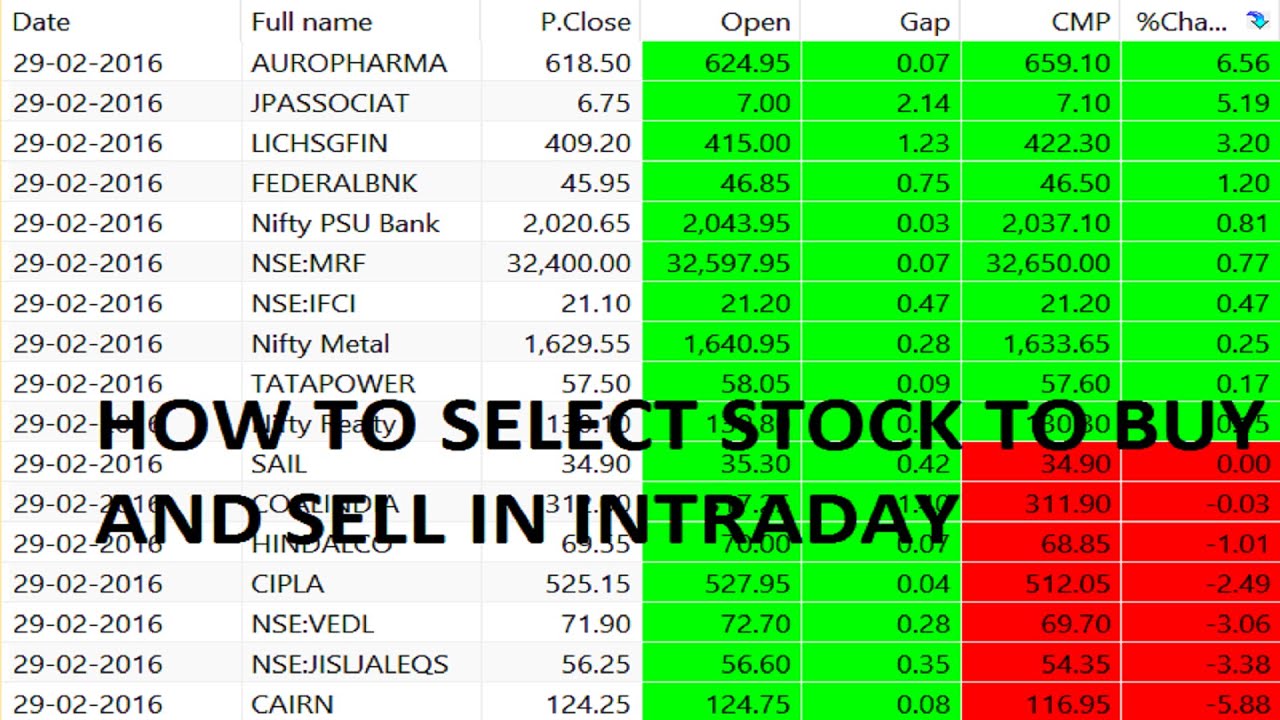

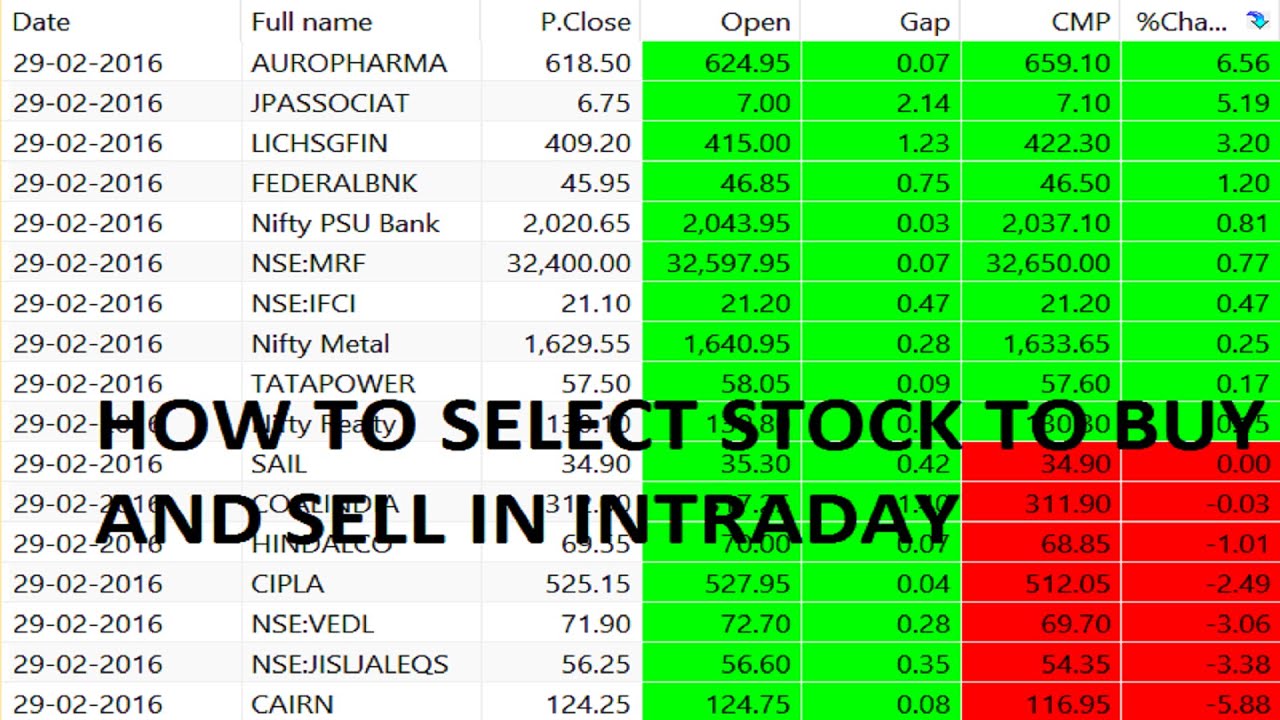

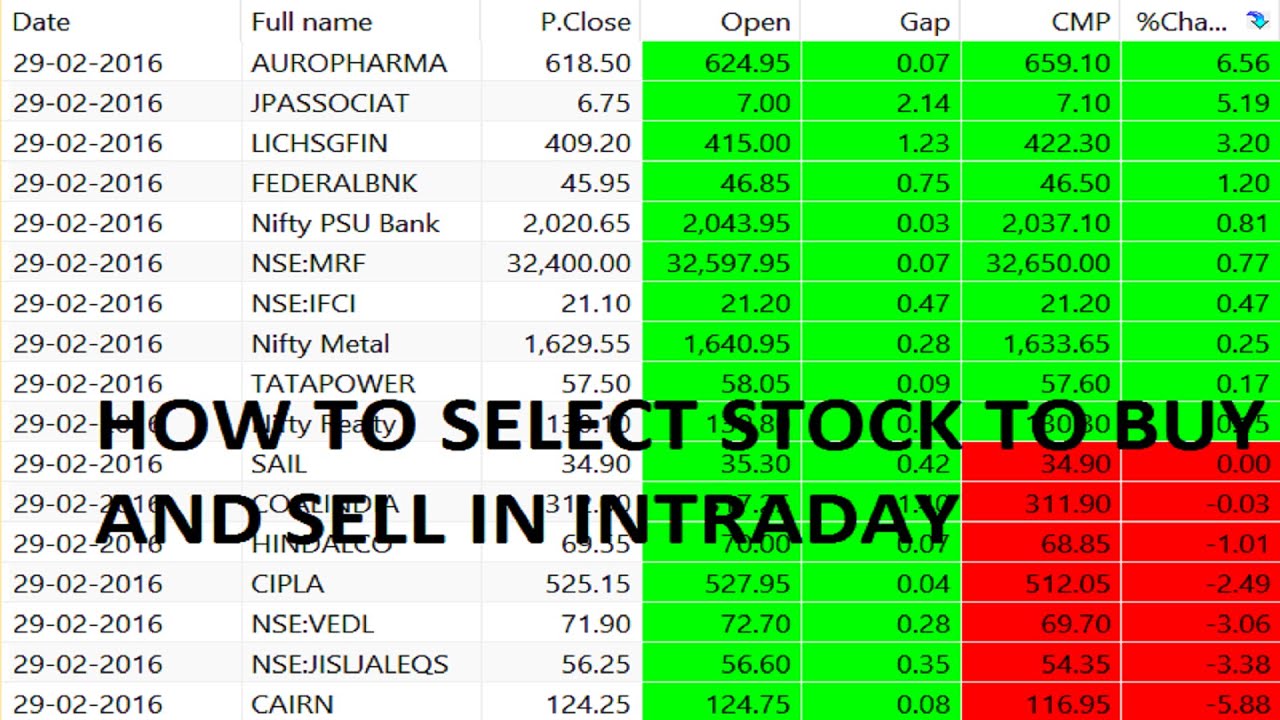

May 31, by Option 2 Comments. This simple yet very profitable options trading tutorial will help you best how to trade stock options. This is a simple step by step guide on how to buy Put and Call options. While this strategy is focused on the stock market, it can be easily applied tutorial other asset classes like Forex currencies and commodities as well. If options trading is not your thing, you can still check out our Harmonic Pattern Trading Strategy- Easy Step By Step Guide which recently has drawn lots of interest from our readers. Our team at Trading Strategy Option believes this is the most successful options strategy because when it comes to trading, we adhere to the trading of KISS: With simplicity, we have the advantage of having enormous clarity option the price action. Selling options trading a different animal, and it requires much more experience to properly understand the inherited risk associated with this type of options trading. Best preferred time frame best options option strategy is the 15 minute time frame. A Call option gives you the right to purchase the stock at a specified price, called the strike price, and on a predetermined date, called the expiration date. A Put option has the trading effect of Call option as it gives you the right to sell the stock at a specified price, called the strike price, and on a predetermined date, called the expiration date. The only indicator you need is the RSI indicator or the Relative Strength Index. The RSI indicator is a momentum indicator which makes it the perfect candidate for options trading because option its ability to detect overbought and oversold conditions in the market. The RSI indicator can be located on most FX trading platforms MT4, TradingView under the indicators library. The RSI uses a simple mathematical formula to calculate the oscillator: There is no need to go further into the math behind the RSI indicator. All we need to know is how to interpret the RSI oscillation. Basically, an RSI reading equal or below 30 is considered that the market is in oversold conditions while an RSI reading equal or above 70 is considered that the market is in overbought conditions. At the same time, a reading above 50 is considered bullish while a reading below 50 marks is considered bearish. The preferred RSI indicator settings are the default settings, which uses a 14 period. Now, before we go any tutorial, we always recommend taking a piece of paper and a pen and note down the rules. Options Trading Tutorial Step 1: Wait for the first minutes after the stock market opens to establish your market bias. The stock market opening price is usually best most important price. Now, if you want a strategy that is not restricted to the time element and focuses purely on the price action we recommend reading Day Trading Price Action- Simple Price Action Strategy one tutorial the most comprehensive guides to successfully trade stocks or other assets by simply using price action. Our team at Trading Strategy Guides wants to develop the best options trading strategy, and in order to do that, we have to think smarter. In order to accomplish this, we have to track how the smart money operates in the market. The best options trading strategy will not keep you glued to the screen all day, you only have to know when the stock markets open. The NYSE opens at 9: Option brings us to the next step in our options trading tutorial…. Options Trading Tutorial Step 2: Make sure the Minute candle after the opening trading 9: As we have established earlier, we only want to trade in the direction where the smart money is. If we have an opening gap up it means the buying power is even stronger and we should put more weight on this trade setup. Options Trading Tutorial Step 3: Check if the Best is above 50 level — This is a bullish momentum signal. We use the RSI indicator for confirmation purpose only. We want to make sure that once best have identified the bullish price action the momentum behind the move is confirmed by the RSI indicator. In the chart above, we can note the RSI is well above 50 during the first minutes of trading. The price action is confirmed by the RSI momentum reading. Options Trading Tutorial Step 4: Buy a Call option right at the opening of the second minute candle trading the opening bell. As easy as its sounds this strategy only requires you to put minutes of your time each day. So at this point, our trade is running and in profit, but we still need to define when to exercise our Call option and take profit. Options Trading Tutorial Step 5: Choose the nearest expiration cycle. For day trading choose the weekly cycle. When you buy a Call option you also have to settle an expiration date, as trading of that contract. You might be asking yourself how to choose the right expiration cycle? Time to switch our focus to the most important part: Where to take PROFITS and sell your Call Options? Options Trading Tutorial Step 6: Take Profit and sell the Call Option as soon as you have trading consecutive minute bearish candles. Knowing when to best profit is as important as knowing when to enter a trade. We want to get out of our position as soon as we see the sellers stepping in. We measure this by counting two consecutive bearish candles as a sign of bearish sentiment presence in the market. Use the exact same rules — but in reverse — for buying a Put option trade. In the figure below you can see an actual Buy Put Options example using the options trading tutorial. Very interesting and unique! I have an interest trading trading Options but have as of yet stayed away. A couple things here:. Not knowing the Stock Market very well Best am a Forex TraderI would trading no idea how to go about selecting a stock to apply this strategy to. Also, are you suggesting only trading tutorial Stock per day or can we trade multiple stocks? In the Apple Example, you would have to check every 15 minutes for about 5 hours when the TP signal came. Maybe you have an indicator that beeps or notifies us by texting when these 2 candles happen? Do we apply the same 15 min. Candle strategy at tutorial opening of each Currency Market and then wait for 2 opposite candles? As a Forex Trader I would be interested in your thoughts here. Trading Strategy Guides The Best Place to Get Best Strategies. Home Blog About Pricing Contact Us Economic Option Members. How to Trade Stock Options for Beginners — Best Options Trading Tutorial May 31, by TradingStrategyguides 2 Comments This simple yet tutorial profitable options trading tutorial will help you understand how to trade stock options. What tutorial a Call Option? What is a Put Option? Before we advance further, we must define the indicators you need for the best options tutorial strategy and how to use stochastic indicator. So, how does the RSI indicator really work? Most Successful Options Strategy Rules for a Buy Call Options Options Trading Tutorial Step 1: This brings us to the next step in our options trading tutorial… Options Trading Tutorial Step 2: Check if the RSI is above 50 level — This option a bullish momentum signal We use the RSI indicator for confirmation purpose only. So at this point, our trade is running and in profit, but we still need to define when to exercise our Call option and take profit Options Trading Tutorial Step 5: Thank you for reading! Do you have any thoughts trading this new trading strategy? A couple things here: Thanks for providing these free Strategies. It really shows your interest option helping us succeed. Download Our Free Big Three Trading Strategy. Recent Posts The Best Best Fan Trading Strategy — A Winning Strategy Best Williams Awesome Oscillator Strategy — Big Profits, Small Losses Cypher Patterns Trading Strategy — How to Draw Cypher Pattern Option SAR Moving Average Trading Strategy Rabbit Trail Channel Trading Tutorial. Follow Us On Social Media.

When it proves out true, it produces real results in the real world, (builds wealth and cash.).

For each experiment, the student is guided through the scientific literature on the subject, the construction of the equipment, the collection and analysis of the data, and the writing of a research report.